-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

MNI BOE Review - May 2024: June Cut Increasingly Likely

The MNI Markets team now assign around a 50% probability of a June cut see a 40% probability of an August cut and see a 10% probability that rate cuts are delayed further.

MNI POLICY: Copom Dissenters Feared Reaction Function Misstep

Dissenters at the Central Bank of Brazil worried about a possible hit to credibility from moving against previously established guidance.

MNI EGB Issuance, Redemption and Cash Flow Matrix – W/C 13 May, 2024

The Netherlands, Germany, Spain and France are all due to hold auctions in the upcoming week while the EU is scheduled to hold a syndication.

MNI Credit Weekly: Shifting Sands

Low volatility persists but idiosyncratic risks are brewing.

MNI SOURCES: Fed, Geopolitics, Feed ECB Caution Over Cuts

Some officials fear the scope for ECB rate cuts may be restricted by external factors.

Putin Formally Reappoints Technocrat Mishustin As PM

Russian President Vladimir Putin has formally reappointed incumbent Mikhail Mishustin to the office of prime minsiter following his approval in a parliamentary vote. Earlier today, Putin submitted his recommendation that Mishustin remain in the role, with the vote a rubber-stamp procedure in the Putin-dominated legislature. Mishustin is viewed as a low-key yet senior figure within the 'technocratic camp' of Kremlin figures. As the FT reports, "The technocratic camp in government, though traditionally seen as more western-oriented, has managed to successfully steer the country’s economy through the first two years of war, maintaining stability despite international sanctions isolating Russia."

- As is custom, the entire gov't resigned prior to Putin's inauguration for another term in office. Little shuffling is expected, with other senior figures including Defence Minister Sergei Shoigu and Foreign Minister Sergey Lavrov - in office for nearly 11 and over 20 years respectively - set to remain in office.

- Maintaining a largely-unchanged Cabinet will be seen as an attempt to show stability in the gov't and Putin's support for his ministers.

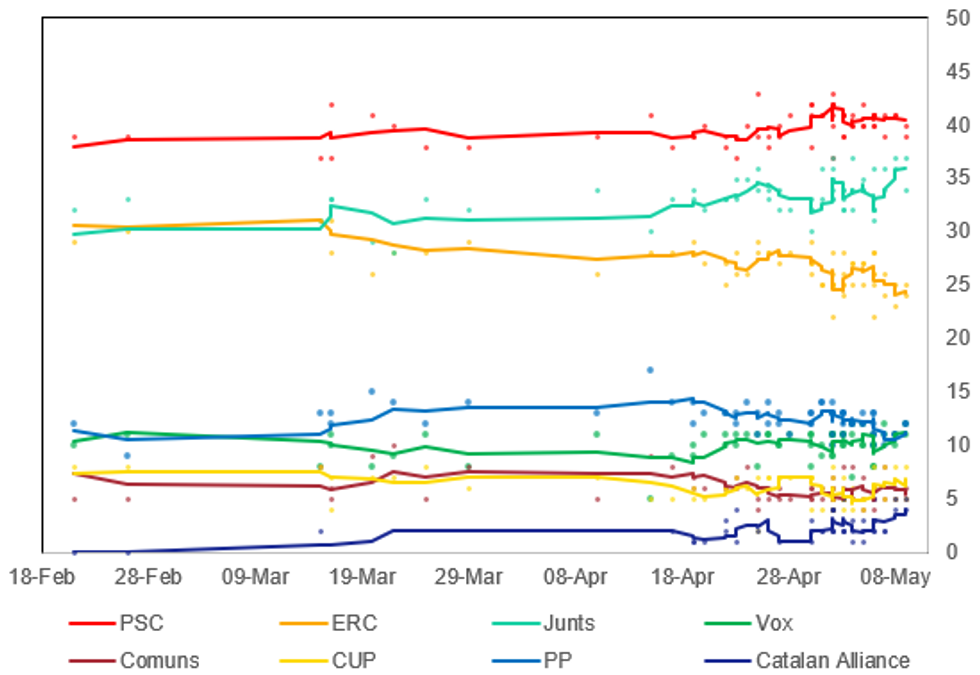

Catalan Election Outcome Could Disrupt Wider Spanish Political Stability

Ahead of the 12 May Catalan election, the outcome remains too close to call. Catalonia has an outsized influence on Spanish politics, with PM Pedro Sanchez reliant on the support of pro-independence parties at the national level to prop up his minority gov't. As such, this election could have a significant impact on the stability of Spanish politics nationwide.

- The centre-left pro-union Socialists' Party of Catalonia (PSC) lead polls, with the hardline pro-indpendence Junts per Catalunya (Junts) in second. The leftist moderate pro-independence Republican Left of Catalonia (ERC), which has previously worked with both parties, could end up kingmaker. Polls show a high proportion of voters (~40% in some surveys) as undecided, making an unexpected outcome possible.

- Averages of opinion polls in May so far shows the pro-union parties - PSC, conservative Popular Party (PP), right-wing Vox, and leftist Comuns Sumar - on 68.6 seats. Meanwhile, the pro-independece parties - Junts, ERC, far-left Popular Unity Candidacy (CUP) and nationalist Catalan Alliance (AC) - average 68.1 seats. With 68 required for a majority, the election is too close to call in this respect.

- The PSC is running on a campaign supporting an amnesty for those involved in the illegal 2017 independence referendum, and advocating 'moderation rather than separatism'. Junts leader, the currently-exiled Carles Puigdemont, argues that if he becomes regional president he will be in a strong position to extract concessions from Madrid due to Sanchez's reliance on seven Junts deputies to prop up his minority gov't.

Source: feedback, GESPO, Sigma Dos, Sociometrica, GAD3, Electopanel, Key Data, Cluster17, YouGov, GAPS, NC Report, DYM, IMOP, 40dB, Target Point, Celeste-Tel, Hamalgama Metrica, MNI

Source: feedback, GESPO, Sigma Dos, Sociometrica, GAD3, Electopanel, Key Data, Cluster17, YouGov, GAPS, NC Report, DYM, IMOP, 40dB, Target Point, Celeste-Tel, Hamalgama Metrica, MNI

Axios-Sec Cab Approves Expansion Of Rafah Op, Could Cross US Red Line

Barak Ravid at Axios: "The [Security] Cabinet approved last night the IDF's "expansion of the area of operation" in Rafah, according to three sources who comment on the details. Two sources stated that this is a "measured expansion" that does not cross US President Joe Biden's red line. The third source stated that the approved action includes actions that could be interpreted by the US as crossing Biden's red line."

- The US has warned Israel about a ground assault in Rafah. Earlier in the week the administration paused shipment of heavy ordnance to Israel, and President Joe Biden has warnedthat crossing the US' 'red line' (the IDF going into 'population centres') would risk the halting of all US weaponry to Israel.

- This would leave the Israeli military stretched, and risk a backlash domestically for Biden. He remains in a difficult position between hawkish Democrats and the GOP calling for continued military aid to Israel, and the vocal, progressive wing of his party demanding a halt to support for the Netanyahu gov't.

- Halting military aid would be an historic step-back from the US, which has maintained support for Israel for decades. Indeed, Biden has previously claimed the US' backing of Israel's security as 'ironclad'.

- Ravid: "The three sources stated that the cabinet also instructed the Israeli negotiating team for talks on the hostage deal to continue efforts to reach a deal and try to formulate a new initiative that would lead to a breakthrough."

Zelenskyy Warns More Russian Troops Could Engage In Kharkiv Assault

Wires carrying comments from Ukrainian President Volodymyr Zelenskyy amid a sizeable Russian assault on the Kharkiv oblast in northeast Ukraine (see 'UKRAINE: Significant Escalation In Russian Attacks Along Kharkiv Frontier', 1201BST). Zelenskyy claims that 'Ukrainian forces were prepared to repel Russian ground attacks [in the direction of Kharkiv]', but warns that 'Russia could send more troops [to] the area'.

- Al Jazeera reported on 9 May "Ukrainian deputy military intelligence chief Vadym Skibitsky said Russia was possibly preparing to make a renewed attempt to capture Sumy and Kharkiv..."

- The likelihood of Russia being able to take the city of Kharkiv, currently deep within Ukrainian-held territory would require a collosal Russian offensive, diverting troops and equipment from other frontline areas on both sides.

- Instead, pushing south from the border around Vovchansk could see a 'buffer zone' set up along Ukraine's border with Russia's Belgorod oblast as President Vladimir Putin seeks to avoid incursions into the Russian Federation by Ukrainian forces.

- Earlier, Reuters reported that according to an unnamed high-ranking Ukrainian military source, Kyiv expects to receive its first delivery of F-16 fighter jets from the West in June or July.

- However, more important in the short-term will be how swiftly the now-Congressionally approved supplies of US weaponry can reach the frontlines to repel Russian advances. The speed of supply will go a long way to determining the ability of Ukrainian forces to hold the frontline over what is likely to be a sustained period or Russian offensives over the spring and summer months.

Source: Al Jazeera, Institute for the Study of War

Source: Al Jazeera, Institute for the Study of War

MNI REAL-TIME COVERAGE

Dour UofM Sentiment Tempers Post-Claims Rally, Rate Cut Pricing Cools

Timely & Actionable Insight on Central Bank Policy

Timely & Actionable Insight on FX & FI Markets

Timely & Actionable Insight on Emerging Markets

Sample MNI

MNI NEWSLETTERS

MNI ASIA OPEN: Countervailing Fed Speak

MNI GLOBAL WEEK AHEAD - US CPI Headlines

MNI ASIA MARKETS ANALYSIS: Dour UofM Sentiment Tempers Risk On

MNI GLOBAL WEEK AHEAD - US CPI Headlines

MNI US OPEN - UK Exits Technical Recession Following Strong Q1 Growth

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.