-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

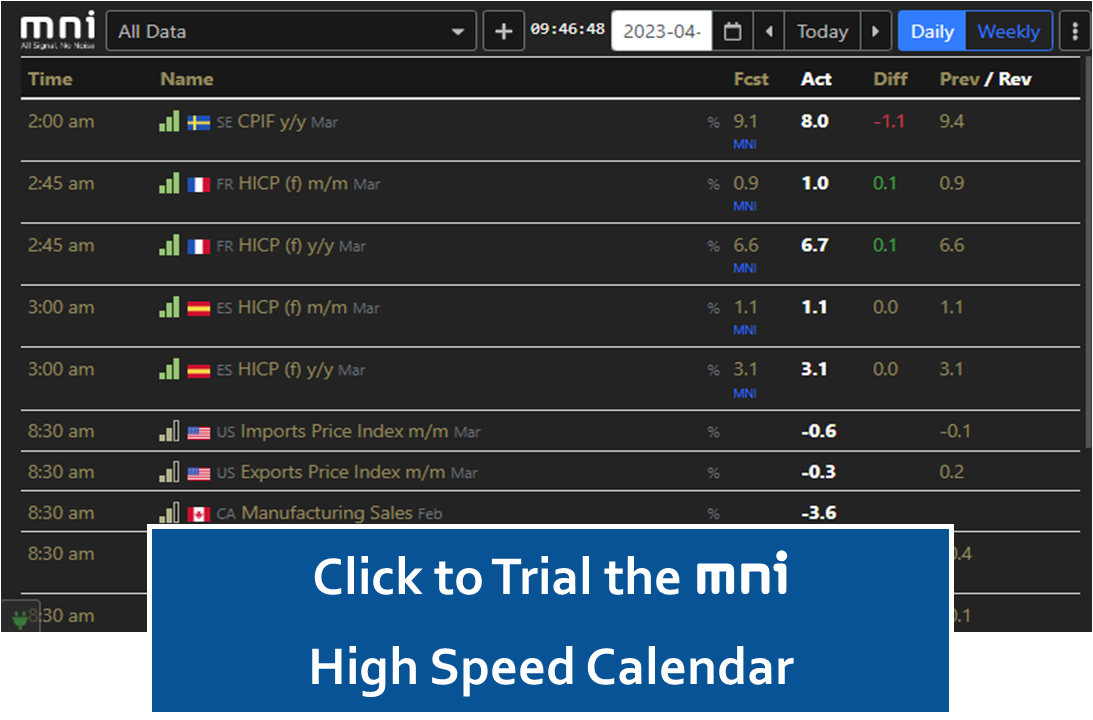

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

MNI Eurozone Inflation Preview – April 2024

Services price disinflation is expected to drag core inflation lower, while headline is set to be underpinned by Y/Y upticks in energy and food prices

MNI INTERVIEW: Risk Next Fed Move Is A Rate Increase - English

Fed most likely to cut interest rates at least once this year, former top aide William English tells MNI.

MNI TV: Key Exclusive Highlights For Week 17

MNI's key exclusive stories for this week

MNI BOJ WATCH: Ueda Flags Policy Change On Weak Yen-Led Inflation

The weak yen has the BOJ concerned and could drive a policy response, according to Governor Kazuo Ueda.

MNI INTERVIEW: Upbeat UK Confidence Read Grounds For Optimism-GfK

UK consumer confidence still negative overall, but pick-up of recent months now finding a solid base, GfK say.

MNI POLITICAL RISK- Blinken Touts Minor Breakthroughs In China

Daily roundup of news from the US.

Executive Summary:

- Secretary of State Antony Blinken met with Chinese President Xi Jinping today in Beijing to wrap up a China trip which hasn’t delivered concrete progress on key points of tension in the bilateral relationship, but may contribute to a trend away from overt confrontation and promised progress on lower-level issues like artificial intelligence and fentanyl.

- Former President Donald Trump's allies are reportedly drafting proposals to exert greater influence over the Federal Reserve. The proposals floated were once considered beyond the authority of the executive but may be more likely considering the current conservative balance on the US Supreme Court.

- White House National Security Spokesperson John Kirby outright rejected a potential Israel-Hamas ceasefire agreement, reported yesterday, which would implement a five-year truce in return for recognition of a Palestinian state.

- The SCOTUS appears poised to rule that former presidents have some level of immunity from prosecution, a decision which is likely to delay Trump's three pending criminal trials until after the presidential election in November.

- A bipartisan group of House Representatives are travelling to the US-Mexico border today. The rare bipartisan trip reflects an increasingly cordial environment in the House since House Speaker Mike Johnson (R-LA) stared down his conservative flank this month.

- President Biden was in Syracuse, New York yesterday to announce another major allocation from the 2022 CHIPS and Science Act pot.

- Poll of the Day: Trump’s decision to stake out an ambiguous position on abortion may have reduced some of his political exposure to the issue.

Please find the full article attached below:

MNI Interview With Former Director Of Fed's Division of Monetary Affairs

- MNI interviews William English, a former director of the Fed's division of monetary affairs -- On MNI Policy MainWire now, for more details please contact sales@marketnews.com

Gov't & Minister Survive Confidence Votes

As was widely expected, both the gov't of PM Petteri Orpo and Minister of Social Affairs and Health Kaisa Juuso have survived votes of no confidence in the Finnish Parliament. The confidence votes relate to proposals to reformhealthcare, which has led to criticism from opponents and some healthcare professionals. The confidence motion against Juuso, from the right-wing populist Finns Party (PS), accused the minister of incompetence after she claimed the cuts to healthcare spending came as a 'surprise'.

- In the event the gov't and Juuso comfortably crossedthe majority threshold, with margins of 86-69 and 85-69 in favour of the gov't and minister respectively.

- This does not mark the end of a series of confidence votes, with the opposition Centre Party and 'Movement Now' submitting an interpellation question to parliament that will see a debate among members followed by a confidence vote. The parties oppose the latest fiscal adjustment package from the gov't, arguing that spending cuts need to be met with investment in order to support economic growth.

- These votes are common in Finnish parliamentary procedure, and given the gov'ts comfortable majority at present are unlikely to cause any notable political instability or alter policy continuity.

Blinken Speaks Following Xi Meeting

(MNI) London - US Secretary of State Antony Blinken speaking at a press conference in Beijing following his meetings with senior Chinese officials including President Xi Jinping and Foreign Minister Wang Yi. Says that the "US is clear about the challenges posed by China", and that "the US will always defend its core interests and values." Blinken's comments treading a fine line between striking a tough stance amid US raising concerns about Chinese 'overcapacity' and support for Russia, while also saying the US is “committed to maintain and strengthen lines of communications”.

- Blinken says he "reiterated serious concerns about China providing components that are powering Russia's war in Ukraine." In Q&A Blinken says he was "extremely clear" in seeking to dissuage Sino-Russian cooperation. Says that "machine tools and microelectronics China is supplying to Russia is having a material effect in Ukraine."

- Blinken on fentanyl (a major source of US animosity towards China): "China has made important progress on fentanyl, but more needs to be done." Says he "Underscored the importance of China taking additional action in particular by prosecuting those selling chemicals and equipment used to make fentanyl."

- On the Indo-Pacific: Says they discussed "China's dangerous actions in the South China Sea", and "made clear US defence commitments to the Philippines remain ironclad."

- On Middle East tensions: "China can play a constructive role in global crises including by discouraging Iran and its proxies from expanding the Middle East conflict."

MNI REAL-TIME COVERAGE

Timely & Actionable Insight on Central Bank Policy

Timely & Actionable Insight on FX & FI Markets

Timely & Actionable Insight on Emerging Markets

Sample MNI

MNI NEWSLETTERS

MNI US MARKETS ANALYSIS: Sharp JPY Recovery Quickly Fades, BoJ Relaxed About Inflationary Impact

MNI DAILY TECHNICAL ANALYSIS - JPY Downtrend Remains Firmly Intact

MNI US OPEN - BOJ on Hold, Yen Turbulent as Intervention Speculation Lingers

MNI Asia Pac Weekly Macro Wrap

MNI EUROPEAN MARKETS ANALYSIS: US Tech Earnings Buoys Risk Mood

MNI EUROPEAN OPEN: USD/JPY To Fresh Highs Post Unchanged BoJ

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.